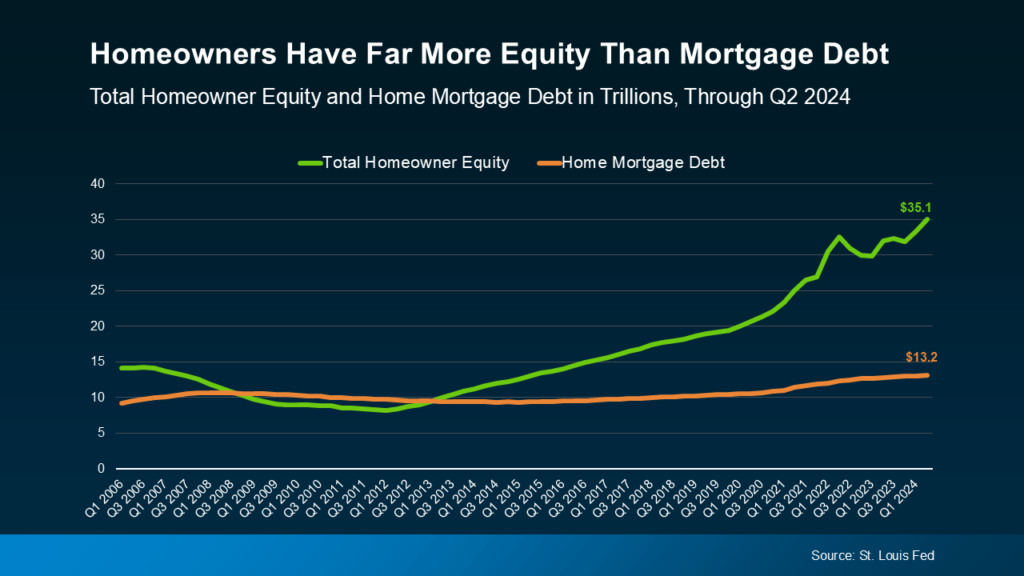

If you’ve heard concerns about rising mortgage debt, you’re not alone. However, today’s housing market is fundamentally different from the 2008 crisis. A key reason? Homeowners are sitting on a significant cushion of equity, creating a much more stable foundation.

Unlike the last housing bubble—when many homeowners owed more than their properties were worth—current homeowners hold far more equity than debt. This dynamic plays a major role in why even though mortgage debt has reached record levels, the market is far from crashing. As housing analyst Bill McBride from Calculated Risk puts it:

“With the recent house price increases, some people are worried about a new housing bubble – but mortgage debt isn’t a concern . . .”

Let’s take a closer look at why today’s mortgage debt isn’t a cause for alarm.

High Equity Reduces Foreclosure Risk

Homeowners today enjoy nearly three times the equity compared to total mortgage debt, according to data from the St. Louis Fed.

This equity acts as a safety net. If homeowners face financial difficulties, they can often sell their home and still walk away with cash in hand, thanks to the value they’ve built over time. Compare this to 2008, when countless homeowners were “underwater,” owing more than their homes were worth and having limited options to avoid foreclosure.

Even if home prices were to soften, most homeowners today are well-positioned to weather the shift.

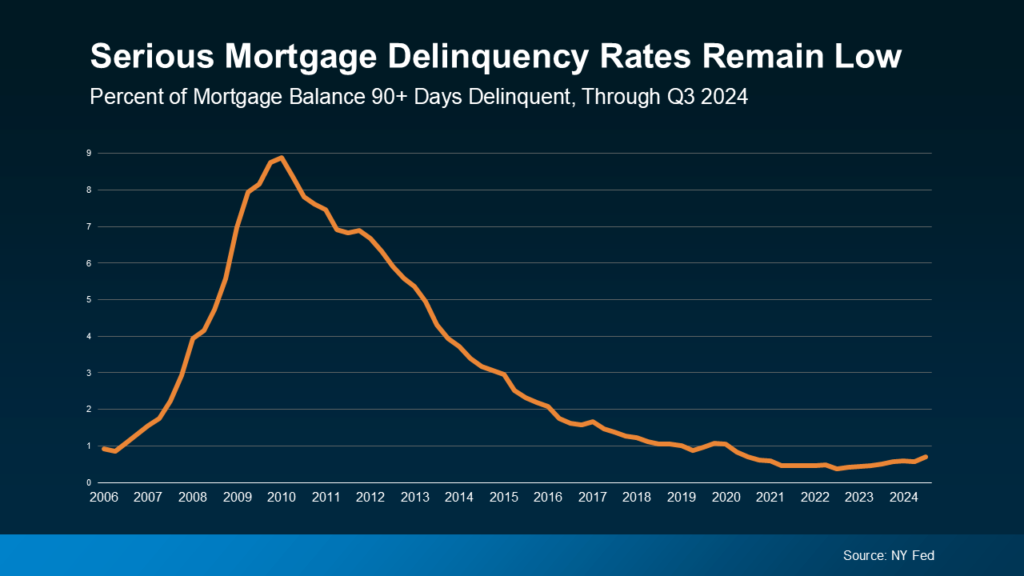

Delinquency Rates Remain Historically Low

Another reassuring sign is the low rate of late mortgage payments. Data from the NY Fed shows that mortgages 90+ days overdue are near historic lows.

Why? A range of programs now exists to help struggling homeowners navigate temporary hardships. Marina Walsh, VP of Industry Analysis at the Mortgage Bankers Association (MBA), highlights this progress:

“Servicers are helping at-risk homeowners avoid foreclosures through loan workout options that can mitigate temporary distress.”

This added layer of support ensures that even those facing financial challenges can often avoid foreclosure.

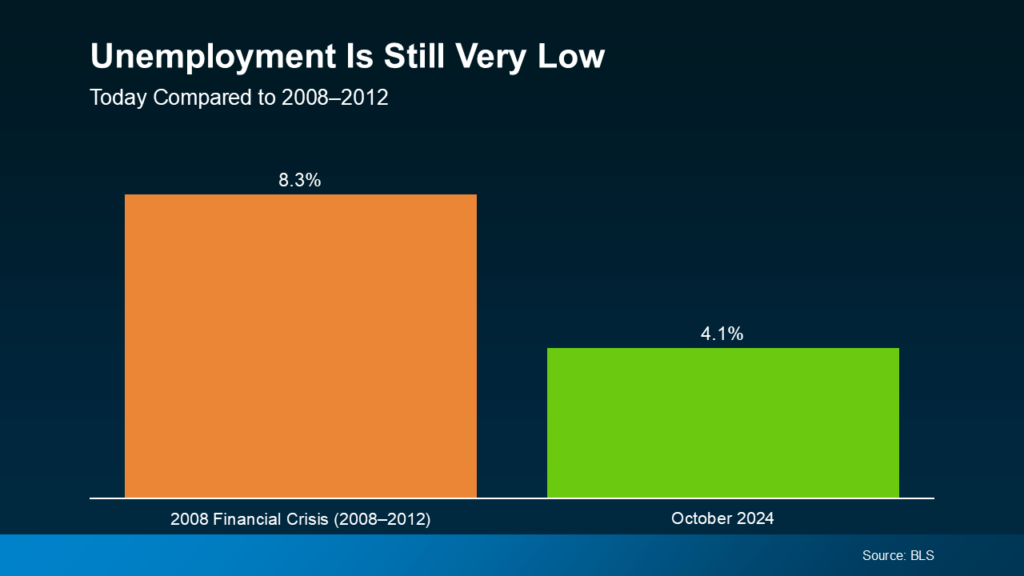

Low Unemployment Provides Stability

One of the strongest pillars supporting today’s housing market is the low unemployment rate. More stable jobs mean more homeowners are able to comfortably manage their mortgage payments.

Archana Pradhan, Principal Economist at CoreLogic, emphasizes:

“Low unemployment numbers have helped reduce the overall delinquency rate . . .”

This is a stark contrast to the 2008 crisis, where higher unemployment drove a surge in foreclosures. With more people employed and managing low-interest mortgages, the risks are far lower today.

No Wave of Distressed Sales in Sight

The bottom line? There’s no reason to fear a flood of distressed sales like we saw in the last housing crisis. Most homeowners today are in a strong financial position, with stable jobs and affordable mortgages. As McBride concludes:

“There will not be a huge wave of distressed sales as happened following the housing bubble.”

While rising mortgage debt might sound concerning at first glance, today’s homeowners are in a far better position than during the 2008 housing crisis. With strong equity, low delinquency rates, and stable employment, the market is built on solid ground.

If you have questions about your home equity or the housing market, let’s connect to discuss your options.